Apr 25, 2025

You are so small -- and that is why you'll win so big in 2025

(And 2026. And 2027. And beyond.)

So before we talk about Curia Financial, let's establish one thing first:

You're not crazy!

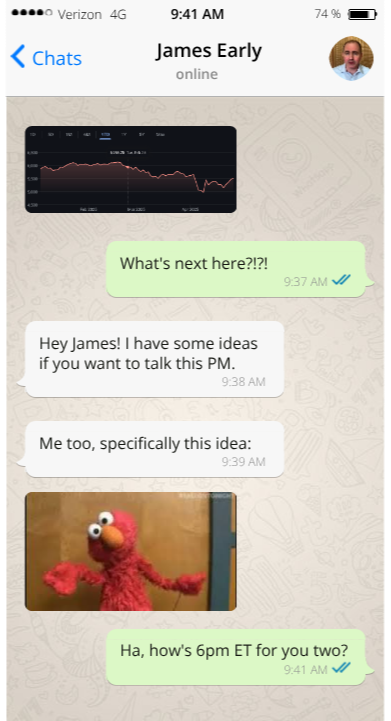

It's just that the stock market is. And the world in general too. Volatility is spiking to levels last seen on the first day of the 2008 crash and the first day of the 2020 lockdown.

And that's just a technical measure. Ask your gut. Your portfolio. Or your spouse. If it feels worse – that's because it is. Way more competing catalysts, way less certainty about when – if ever – we'll be back on solid ground.

Yet there are actually more great investing opportunities out there for you now than I've seen in my 25 years of market research.

My name is James Early.

And I'm about to admit something that you'll pretty much never hear a "Chief Investment Officer," "C.E.O.," or "Director of Research and Analysis" say out loud. (They keep giving me these titles for some reason.)

I've been feeling just as confused as you.

And, in fact, I did the same thing you probably do whenever you feel seasick about life. I "texted" some of my friends!

I started private-messaging the small handful of elite stock analysts whom I actually trust.

And all of a sudden, I was seeing things differently. First I felt relieved. Then I felt excited. Then I felt – well, maybe a little greedy.

I don't have permission to share all of their names with you just yet.

But each of this group shares a few things in common:

1) They all have a documented, long-term track record of outperforming the general S&P 500 in all sorts of stock market conditions.

Yes, you've literally seen, heard and read them everywhere: CNBC, The Wall Street Journal, CNN, Fox News, NPR, BBC, heck even LeBron's personal Twitter page. Their résumés are littered with hedge funds and Fortune 500's.

But the part that actually matters is their results. One of these guys was super early on NVDA, Bitcoin, Tesla – you name it. Another is the closest thing I've seen to a young Warren Buffett... his portfolio returned 41% in its first year and a half. Another one beat the market 10 out of 10 years in a row, while taking substantially less risk. (OK, that last one was me.)

2) They all care more about Average-Joe investors like you than they care about industry awards or cocktail parties.

And that means putting their money where their mouth is, in more ways than one.

Each one of them has run a successful paid subscription advisory with at least 100,000 readers – and also invested themselves in the very same stocks they recommended to those readers. Good luck finding both of those traits in the same investing jock. It's like hunting for a unicorn that only chews on 4-leaf clovers.

3) They're all wise enough – and humble enough – to realize we're better together.

"Us" as in our little group. Our curia. As weeks go by we've been talking more and more. But also "us" as in you – their paying subscribers.

(Plus millions of readers & viewers who might recognize hey it's that guy who flickered on their screen once, and actually seemed to have an ounce of sense.)

It's also the one that's most important to me in 2025. And to you as well if you're reading this.

The internet age gives you way too many investing "gurus" and "talking heads." (With another year or two of A.I. advances, that number of bad choices will literally be infinite.)

I'd give examples here, but I'm too polite. And it's a waste of your time to try to describe the air you breathe.

The world of TV financial media gives us the talking heads. Much like the pregame studio show hosts in the world of sports, they tend to toss out prediction after prediction with total confidence. But no accountability or follow-up.

The world of online newsletters gives us the gurus. At least they have the courage to make actual, on-record stock recommendations. If you can swim your way upstream in the flood of braggadocious marketing hype to even find them.

What do these two all-too-common styles of investment analysis share in common?

They will never take you seriously.

Which means they will never admit they're wrong. Which means they will never learn anything about a changing world. Which means they will never actually help you make money & live well.

And now, as these two worlds converge more & more, you're seeing the worst of both.

The artful dodging and word salads of mainstream financial media are crashing into the pro-wrestling frenzy of online newsletters.

Leaving you stuck with fewer and fewer good alternatives.

A year with a beginning so bizarre, so unprecedented in the history of the stock market, and of life in general, that we'd all sprouted at least 12 months of new gray hairs.

By mid-February.

None of the seasoned insiders in my person "curia" has ever seen anything like this before. Yet all of us are also seeing hidden advantages.

(I have the most gray hairs in our group, which means our collective range of reference goes back to the 1999 bubble. But if you're old enough to remember 1973, the charts are painting a similar picture. And if you're old enough to remember 1929, email me and I'll literally buy you a drink.)

This isn't the time for technical talk – you'll get that from us in due time.

What I do want to say now is that our hidden advantages here aren't limited to pricing – i.e. the market is directionally down and some stocks are down more than others – nor is it limited to valuation – i.e. this down pricing should not be so, because these companies are well positioned to be cash cows for years to come.

There's something more:

You will never find better "clothes" than when all the emperors are standing in front of you not wearing them. (If you know where to look.)

Take the emperors for whoever or whatever you want.

Financial experts? Political experts? All these new experts who say you can't ever believe the old experts? It's like that famous summary of how things work in Hollywood:

"Nobody knows anything." – William Goldman

Your real problem is finding the faint, underlying signal beneath all this noise.

The one that will benefit your own curia. Your closest family, friends, and allies.

We're experiencing history-in-the-making. As the saying goes, we are cursed to live in interesting times.

This kind of extreme volatility throws every single prediction, every single estimate, and every single business model for a loop.

So when it comes to public companies and their corresponding stocks, bonds, and other financial instruments – the weak will flourish and the strong will survive.

Weak as in slow to adapt. Strong as in eager to learn and grow.

In other words, this will be a bumpy road. But it's also when we'll start to see real innovation and real excellence. And see them get rewarded.

Too-big-to-fail is over; welcome to the age of too-late-to-learn. This is the secret factor that favors us (and you).

To be clear, our group is very diverse on methodology. So yes, some of them are zeroing in on the kind of emerging companies that really shine when the need for a true breakthrough overtakes the need to shovel PowerPoint slides to bored VC's who are throwing cheap cash around like drunken sailors.

(Investing just $1k in the Microsoft IPO during the teeth of that mid-1970s market chaos would grow to five million dollars. What if that same opportunity is out there right now?)

Personally, I've got my eye on some classic blue-chip stocks and dividend payers right now with 9-figure market caps. Whether it be buying them on a dip, or even trading options on their movement. These are the rare few "big" companies that are showing that same thirst to learn & adapt.

So:

The only "too big" that really matters here is the one your mom never stopped telling you about – "too big for their britches."

We are going to be wrong. All the time. But we're going to be right much more often, just like we always have. Being honest about that is what brings us together. And coming together is what makes us stronger.

As a famous mathematician once said:

"All models are wrong, but some are useful." – George Box

And when you bring together a handful of proven winners, who sharpen each other with their divergent viewpoints – those models become very useful indeed.

Which is why, as you've no doubt figured out by now:

We've decided to make our Curia a permanent investing "alliance" – and seal our guarantee to you that we'll stop keeping it all to ourselves.

So when I said we're "small" at the top of this page, I did mean it literally.

There are only a few of us analysts. And only a few hundred thousand of you readers, give or take.

Pretty trivial in a world of trillion-parameter algorithms dancing a tango with trillion-dollar economies.

But that also means that we're small where it really counts:

We're humble. We need each other. And today is just the beginning.

I realize that's frustratingly vague. But you'll be seeing more from us in the days and weeks to come.

Like our favorite stocks that we're watching right now.

And a whole lot more.

Starting with our first "pilot episodes" of Curia Now, which will air next week.

And continuing with our Curia Weekly email bulletins, which are also 100% free.

Just take a look, and if it's not your idea of a good time – no problem.

You'll find your "curia" out there. Hopefully sooner than later.

But it's also fair to say:

You won't find anything quite like this, anywhere else.

– James Early, C.E.O. of Curia Financial