Dec 10, 2025

Wall Street's top 10 new scams

I’ve partnered this week with George Noble... the investing legend who ran the #1 mutual fund in America... and dished out a +27.5% average profit. To work on a big upcoming event that we’re calling "George Noble’s Holiday Roast."

And as a loyal subscriber to Curia Financial, you'll get all of our related research material for free. So please read more from below, and don’t forget to register for the “Roast” here, so you don't miss it on December 12th at 12:12pm EST.

-- James

We're almost to the finish line here.

In less then 48 hours... we roast...

Meanwhile, our latest "deadly sins of today's market" tutorial is all about:

Snakes.

(What did you think we were roasting here, a turkey?)

And it begins with a stranger-than-fiction true story about the British colonial regime in India.

You see, they were trying to manage an onslaught of deadly attacks in the capital city of Delhi.

Not bombing attacks by revolutionary insurgents... or philosophical attacks by maddeningly persistent old pacifists wearing only a loincloth...

Venomous cobra attacks. 🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍

Which is why George has rather cryptically labeled today's topic:

A Fresh Barrel of Snakes: Wall Street’s Favorite New Accounting Scams

You see, the colonial governor came up with a very clever plan that any Econ 101 student – or Federal Reserve Chairman – would surely love. He would empower the entire population of India by incentivizing them.

To kill cobras. For reward money.

Which they did, with great enthusiasm. You threw a cobra head in a bucket at the local police office, you got a coin worth 1/16 of a rupee. In some of the hardest hit provinces, the local officials jacked up the price to 1/2 a rupee.

It was a huge success. Or was it?

You see, it turns out that the colonial policy had created a "perverse incentive."

(Stop me if you've heard this one from the man in the loincloth before, but cruelty is only half of the problem with colonial occupations. As Gandhi taught us, the other half is pure stupidity.)

The economically struggling locals took the only logical step and started breeding more cobras to get more reward money.

And then, of course, deaths from deadly cobra attack eventually became more frequent THAN EVER BEFORE.

To state the obvious:

In our analogy today, the SEC and its financial market regulations are the British Raj, and Corporate America's CFO's and accountants are the cobra farmers.

In other words, you can often do more damage by following the letter of the law than you can by breaking it.

But if you grasp this point already, we don't need any more history lessons.

We can just follow a similar format to what we used on the IPO topic the other day.

(Which was something like a "smash hit," if your email replies to me at [email protected] are any indication. Remember... you can direct your questions to George there, and he'll answer them at the Roast.)

But instead of frequently asked questions, let me just bang out a classic David Letterman style top-10 list.

Remember, these practices are very often 100% legal if performed "correctly." That's why they're so dangerous! And why they require extra scrutiny from investors like us:

Halftime break!

But I wonder if you can guess what comes next?

Because if you can play games with supplier financing, you can also do this...

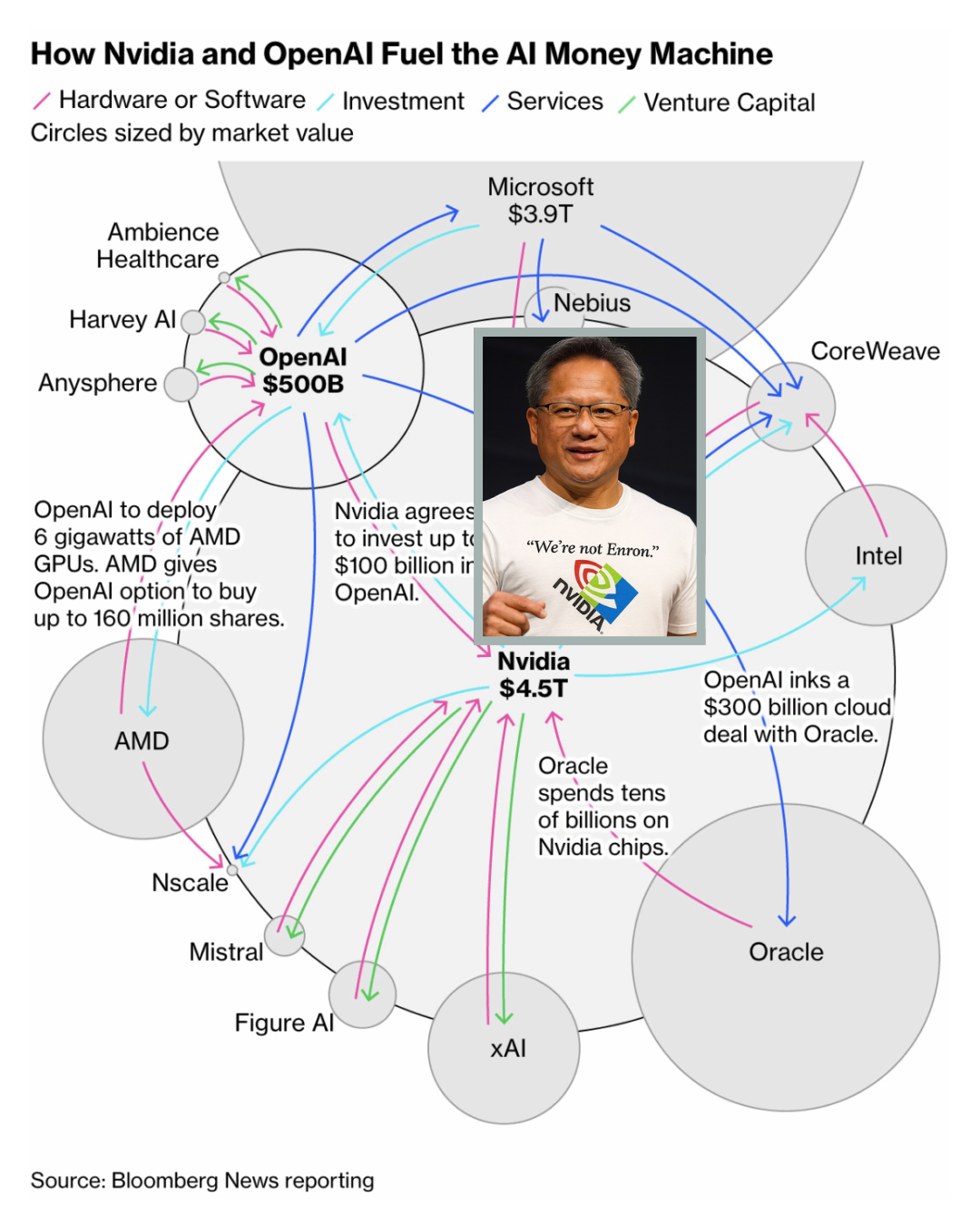

Investing in your own buyers is actually a sound business practice, and it's old hat on Silicon Valley.

The theory is that you may have some buyers who are cash-poor now, but could soon become huge cash-payers as they obtain their own growth & financing.

However, that means you have – either formally or informally – a debt position in your own buyers. Maybe even an equity position. Which is a lot riskier than accounts receivable.

In other words, down on the snake farm, not all revenues are created equal. And that risk is what's not properly reflected in the standard accounting.

Ergo:

And now let's quickly snake our way through the home stretch:

And the subject of executive pay leads us right to our final perverse – but still more or less legal – accounting trick.

This last one has been a particular bee in George's bonnet lately.

(Sorry, I'm mixing metaphors here. A snake in his turban?)

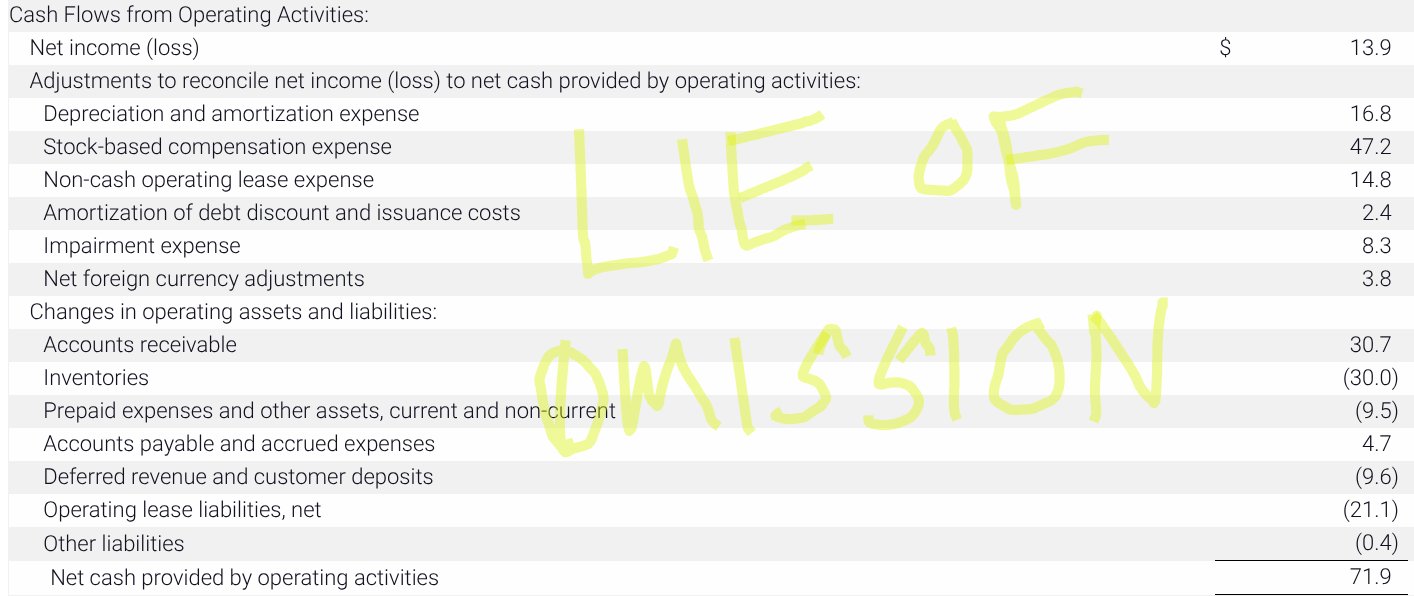

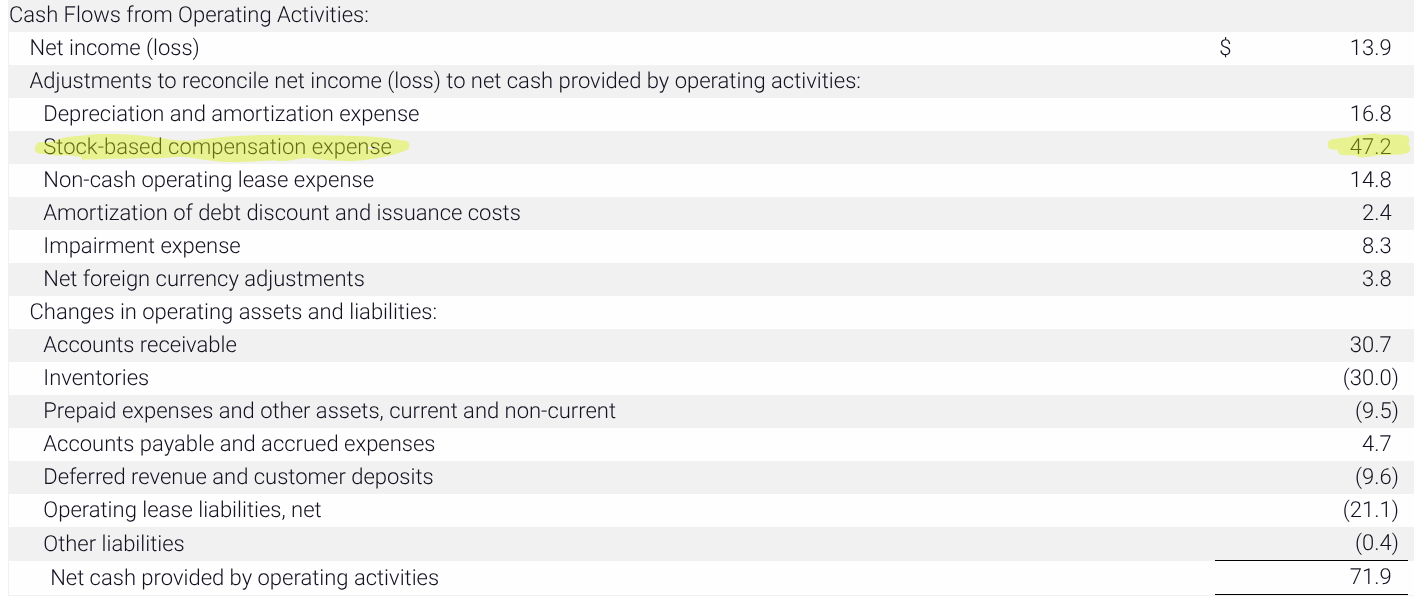

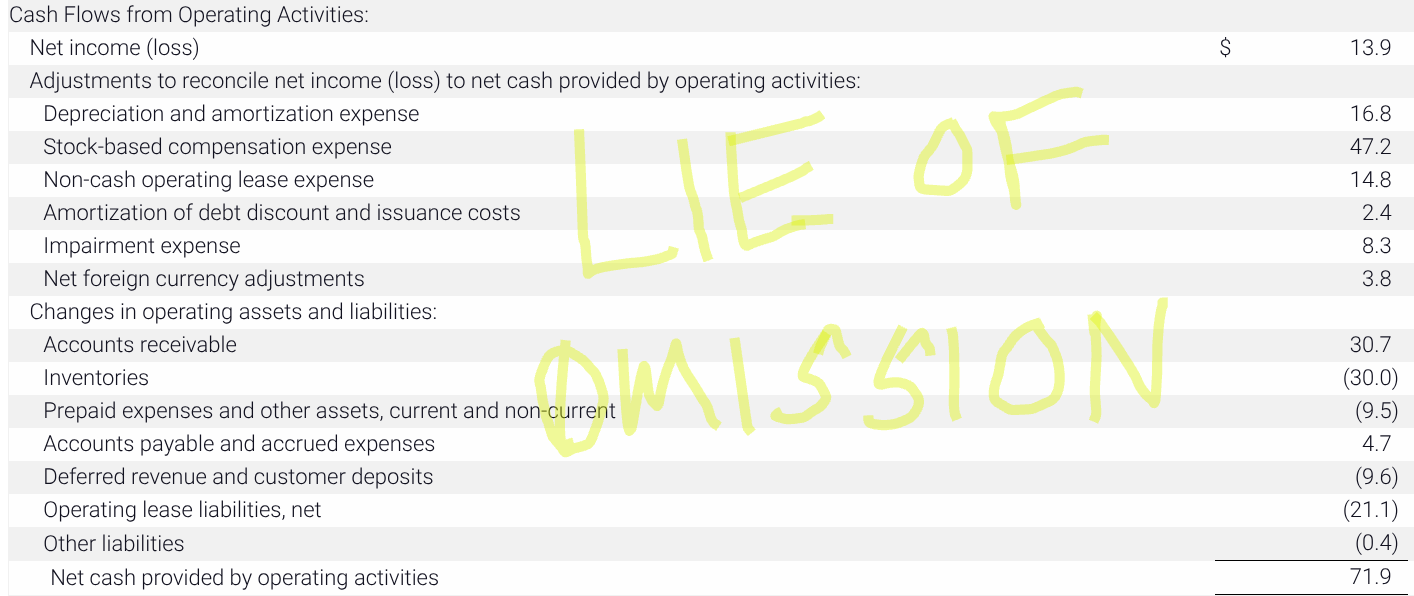

Just take a look at Peloton. Here's their most recent cashflow statement. Notice how the one item I highlighted dwarfs all the others at $47 million just for the quarter:

So you would surely think that this would show up in their income statement.

You know, the one that Wall Street analysts use to make all their price predictions. And therefore the main thing talking heads will yak about to you on TV.

It's not there, and for good reason.

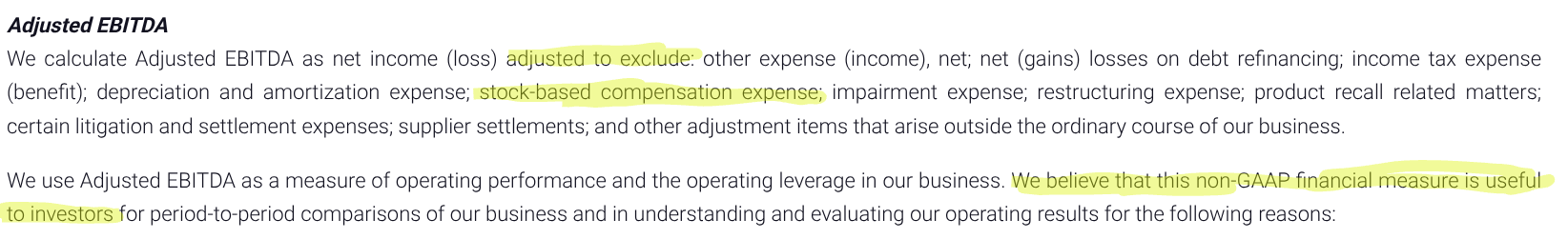

Then they tie a bow on it with the following weasel-worded fine print footnote:

See they're just doing you a favor by making their income up to be whatever they want it to be, in violation of GAAP (generally accepted accounting practices).

This is "useful to investors."

Well, that's enough from us today.

It's starting to smell like burnt cobra in here.

And I don't know about you, but that's got me looking forward to what else – and who else – we can throw on the fire at George's roast.

P.S. Here's #0... #1... #2... #3... #4... and #5 in our series, in case you missed anything.