Dec 23, 2025

3 Stocks for 2026

Dec 23, 2025

Our CEO, editor in chief, and investing Swiss Army knife - covering income, macro, and a bit of everything else with a unique flair for storytelling. James is the former Director of Research & Analysis for The Motley Fool, CEO of Stansberry China, and Chief Investment Officer of BBAE. The last time he ran a premium recommendation service, it beat the market 10 out of 10 years in a row across the most turbulent decade of the past century.

Read moreFrom investing ideas, to interviews with luminaries, to contentious roundtables, to conventional wisdom at unconventional times, Curia Financial brings you fresh, above-the-fray thinking.

Feb 5, 2026

David Trainer does boring stuff. He makes minor adjustments to accounting data. Who would want to think about accounting numbers – let alone minor adjustments to them – when there's

Read more

Jan 29, 2026

Federal debt now exceeds $38 trillion — more than $200,000 per taxpayer. According to the CBO, the next decade will add another $20 trillion. That math matters. Recent dialogue about

Read more

Jan 7, 2026

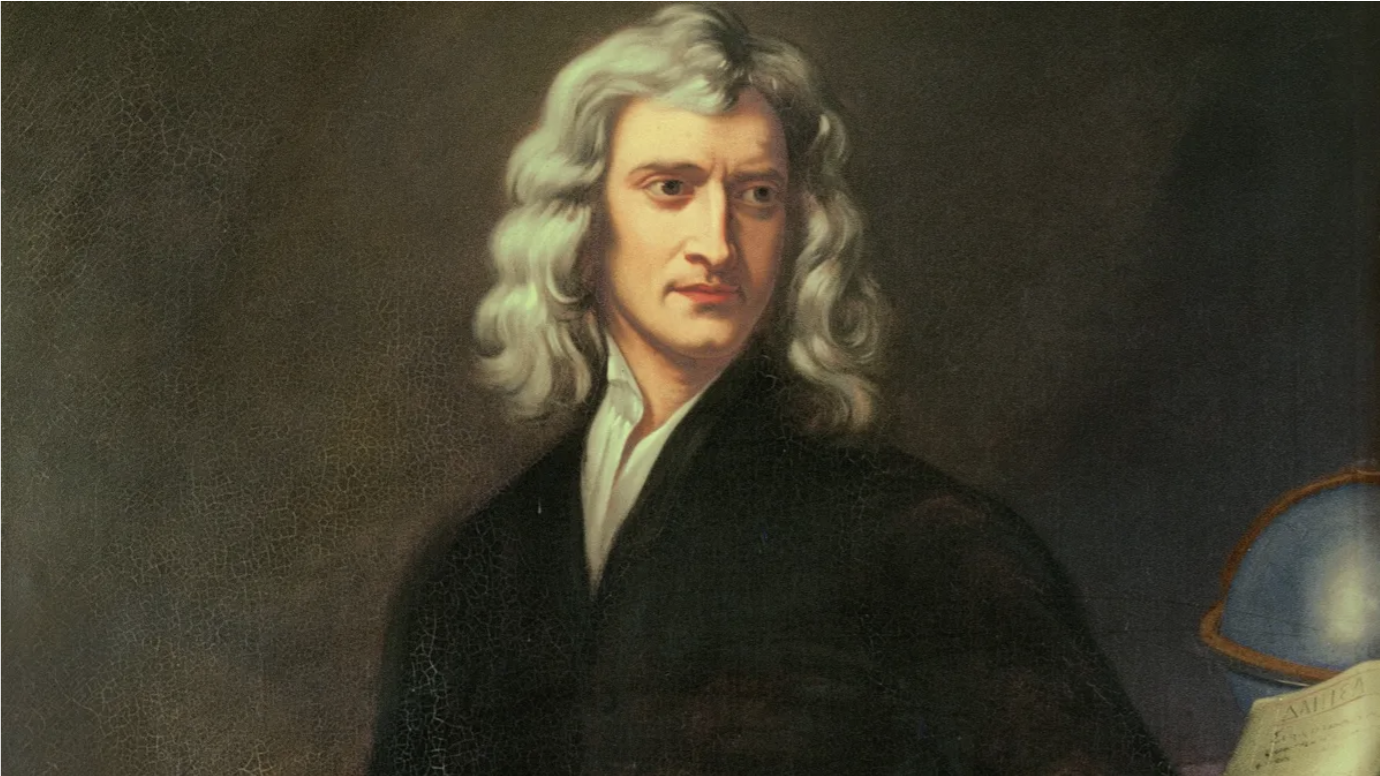

I can calculate the motion of heavenly bodies, but not the madness of men. -Isaac Newton New years beget new predictions. But two things are true about the social sciences:

Read more