Dec 11, 2025

LAST CHANCE before you get roasted [24 hour warning]

![LAST CHANCE before you get roasted [24 hour warning]](https://www.curiafinancial.com/content/images/2025/12/Screenshot-2025-12-11-4.12.02-PM.png)

I’ve partnered this week with George Noble... the investing legend who ran the #1 mutual fund in America... and dished out a +27.5% average profit. To work on a big upcoming event that we’re calling "George Noble’s Holiday Roast."

And as a loyal subscriber to Curia Financial, you'll get all of our related research material for free. So please read more from below, and don’t forget to register for the “Roast” here, so you don't miss it on December 12th at 12:12pm EST.

-- James

All the stocks are hung by the chimney with care.

Because tomorrow we'll all wake up to:

Last chance to mark this on your calendar for the webinar at 12:12pm EST. So I'll repeat the same links George gave the other day:

Google... Yahoo... Outlook... AOL... and none of the above.

I still owe you one more "deadly sins of today's market" tutorial here:

The Ultimate Price: What We Talk about When We Talk about Valuation

But I don't want to exhaust all your energy so soon before the main event. And I don't want to step on George's toes too much.

This is probably his #1 favorite subject.

(And his mastery of this subject is probably why he was able to consistently pile up those market-smashing 27.5% annual returns year after year, to become America's top mutual fund manager.)

So I know he'll cover it in great depth tomorrow. It's likely that we'll spend more time discussing valuation than any other topic at the Roast.

Long story short. As you can guess, value means something different than price.

And some of the key questions that George advises us to ask about it are:

To whom?

Because why?

Compared to what?

And most importantly:

For how long?

Just think about that last one in particular. Investing can be fun, but it's not a game. Your own real life – your time horizon for spending all the money you stack up, and your reasons for spending it – that's everything.

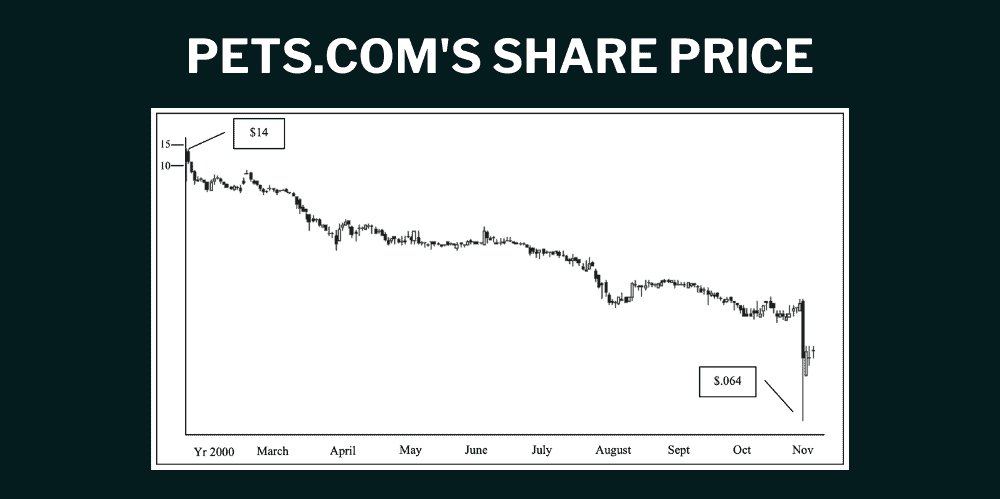

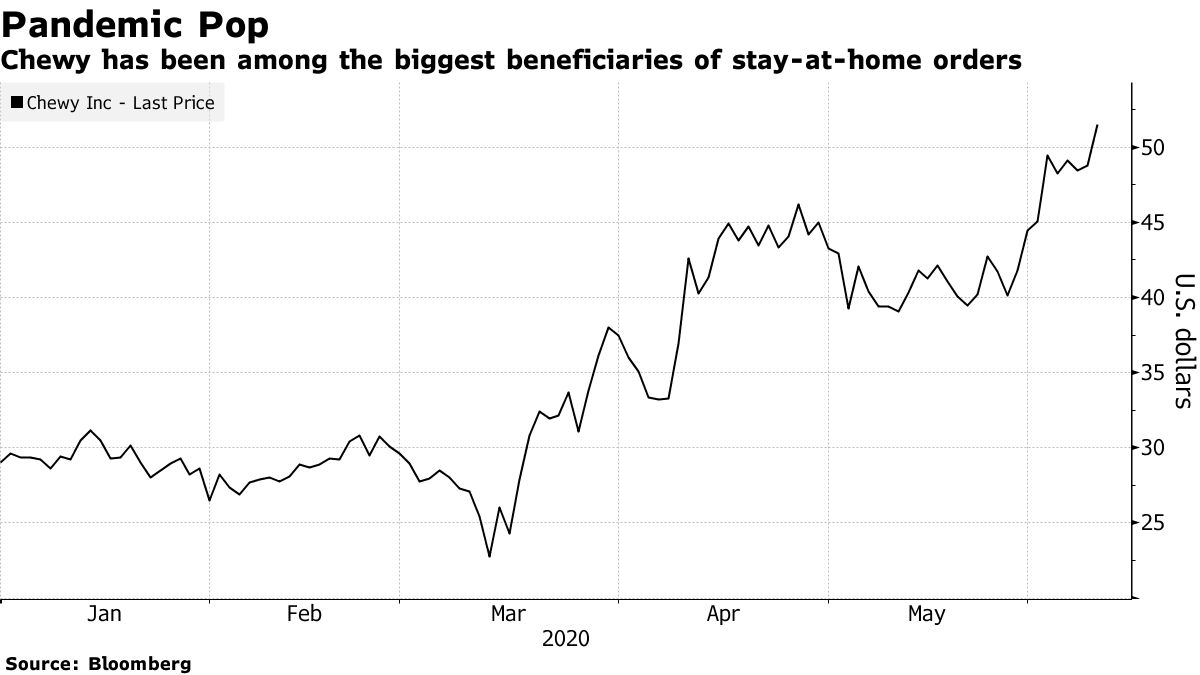

To cite an extreme example... what if your investing thesis was that online shopping for pet supplies would be the next big thing?

(The "who" is you, and the "why" is your thesis.)

Well, your outcome would depend on the time horizon of both your prediction and the time horizon of your intended entry and exit. ("For how long.")

Which could range from this:

To this:

And as for "compared to what"... I can't say it any better than George does himself in his most recent interview with Charles Schwab.

If you can't get enough of him roasting Tesla and OpenDoor, go ahead and watch the whole thing. It's pretty short.

But if you want to fast-forward to the "compared to what" analysis, start at the 1:56 mark and listen to what he has to say about the valuation of gold.

He was early to call this historic bull run, but now he's painting a cloudier picture.

(You may need to click that underlined link if the video doesn't display automatically in your email.)

And yes, gold is another crucial topic we'll delve into at the roast tomorrow.

It's been my pleasure getting you warmed up here.

And I greatly appreciate the time & focus you've put into this tutorial.

Our hard work is over. It's time to roast... and time to feast.

See you there!

P.S. Here's #0... #1... #2... #3... #4... #5... and #6 in our series, in case you missed anything.

P.P.S. I know we talked about a 12,000 capacity limit for the event tomorrow. But feel free to invite any friends, family, or Treasury Secretaries you may know. A few more won't break our website. Just show them this poster. Or to make it even easier, just give them this link.