Jan 7, 2026

Isaac Newton's Investing Advice for 2026

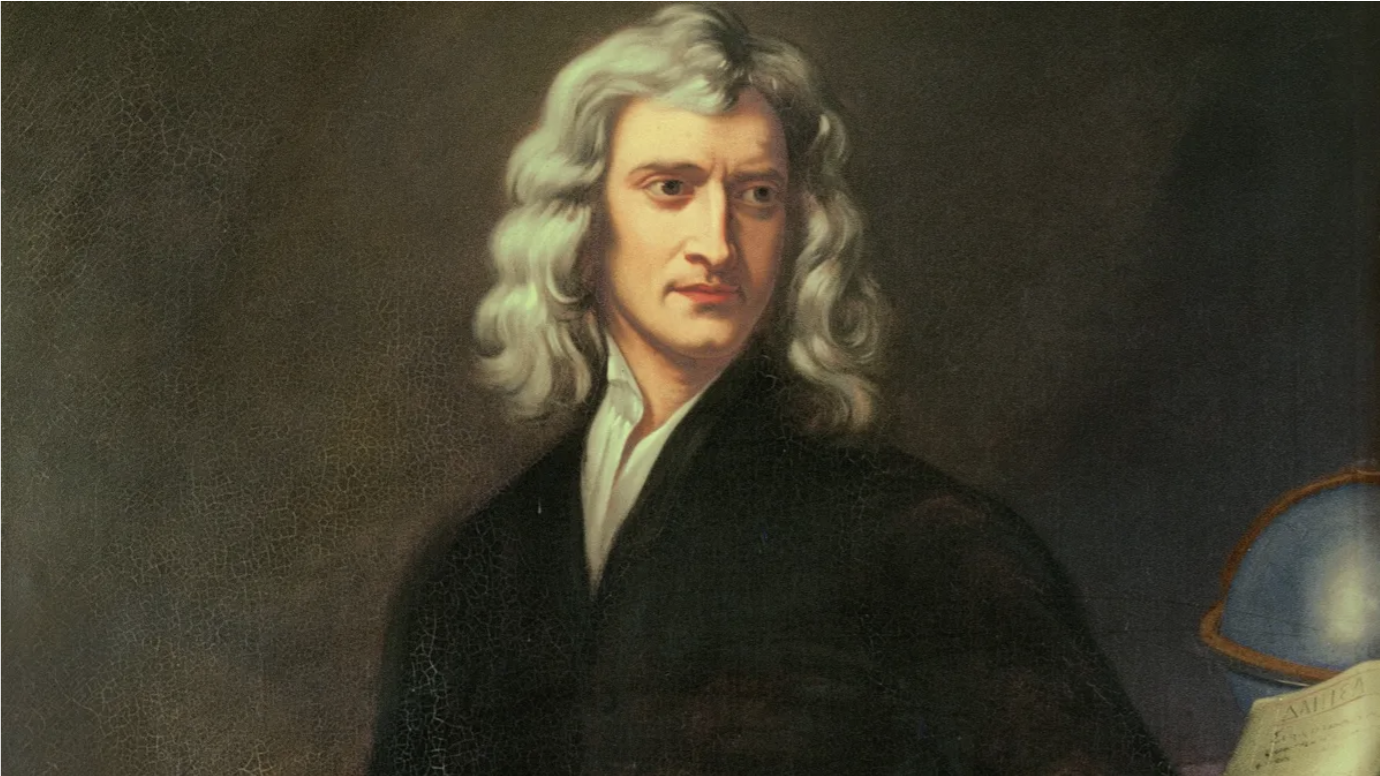

I can calculate the motion of heavenly bodies, but not the madness of men.

-Isaac Newton

New years beget new predictions. But two things are true about the social sciences:

- Human predictions in the social sciences tend to be so wrong that making them is almost irresponsible.

- Humans have to make social sciences predictions anyway.

In addition to Newton’s anecdotal experience, examples abound demonstrating the ineptitude of economic and investing “forecasters.”

But our struggle with the social sciences applies anywhere people are people.

Pretend I flip a coin.

While it’s rotating in the air, would you dare be confident – enough to commit the rest of your life – to either a heads or a tails outcome?

Most people would say “no,” but yet people assuredly walk down the aisle every year despite the fact that first marriages have, depending on country and data set, a coin flip’s odds of surviving. (Second marriages in the US have a 40% chance of success, and third marriages have a 30% chance, so even worse than a coin flip.)

Our confidence in our partner being “the one” may be misplaced for 50% to 70% of us, but there’s another side of the marriage coin: If we beat ourselves up and take no action for fear of statistics, we’re missing huge benefits.

Marriage increases life expectancy, and many marriages – whether first, second, or third – do stay the course. Pair bonding also perpetuates the human race, and kids of married parents fare better, too.

Marriage can be either irrational or essential, depending on your perspective.

Investing has elements of this.

Confidence itself epitomizes the irony of the social sciences: It may not be justified rationally, but because of how human hardware works, confidence is necessary to create outcomes with other people.

“I feel like marrying you at the moment, but statistically speaking, one or both of us is likely to fall victim to infidelity, financial woes, drug or alcohol problems, or simple uncaringness that, again statistically speaking, will have about a 50% (or 60% or 70%) chance of ending this marriage” isn’t going to make the sale on a spouse.

Confidence may not have bearing on the act of investing itself, but it has tremendous bearing on the investing industry.

Why is Picking Stocks Hard? Let Me Count the Ways

Back to some stats that support the irrationality part:

- Over any given 20-year rolling period, 94% of large-cap mutual fund managers lose to the S&P 500. How good are their predictive powers? How rational is it for long-term investors to keep enabling them?

- If we combine professor Hank Bessembinder’s finding that, from December 1925 to December 2023 (nearly 100 years), just 3.2% of stocks delivered all the market’s gains with the statistic that 40% of stocks go to zero and 60% lose money for investors, how rational is selecting individual stocks?

- From 2003 to 2023, if you’d missed the best 1.9% of trading days (60 days) in the S&P 500, your returns would be 93% lower.

- From the same time period, your returns would be 2,105% higher if you’d missed the worst 1.9% of trading days.

- Ned Davis Research found that while the S&P 500 delivered 10% returns annually over the past 30 years, the average US mutual fund investor earned just 4% annually due to worse fund selection and worse timing.

These stats paint the picture of a small number of stocks and small number of time periods driving the bulk of investment returns, and that it’s almost a fool’s errand to try to predict either or to pay someone who purports to. (My colleague Shaoping Huang covered this in a recent Curia article.)

The other side of the investing coin is that, as Ned Davis Research says, the S&P 500 has compounded at 10% annually.

That’s enough to turn $500 given to a newborn 70 years ago into nearly $500,000 today.

It seems comparably irrational to miss out on the aggregate power of the largest US companies adding market-recognized value over decades.

Granted, we may be seeing a weakening of the US financial empire, but many foreign companies have shares trading on US exchanges, and investing abroad is relatively easy these days anyway.

Investing predictions, then, may fall into two buckets. For example:

- Likely-to-be-foolish prediction: Asset X will be worth ___% more in three months.

- Likely-to-be-accurate prediction: A rolling bucket of the world's best companies will continue to add value to the world (value that’s measured in earnings and market appreciation) over the next 10, 20, and 30 years.

You probably already believe #2, at least on some level, if you’re an investor.

But what about specific stocks?

As someone who defied the odds by running a stock research service whose recommendations beat the S&P 500 for all 10 years of my tenure, I say this:

- Beating the market with individual stocks is very hard, but not impossible.

- The fewer predictions you make, the better.

- Short-term predictions are either impossible or obvious, and the obvious ones are already priced in.

- You can ignore risk-related predictions that don’t affect your investing horizon. For example, if you have a 15-year horizon, you probably don’t need to worry if 2026 is the year the AI bubble bursts.

- The most reliable investing predictions, in my opinion, are that human cognitive biases will continue (this is almost axiomatic because they’re hardwired into human brain physiology).

No-Thesis Stocks

I’ll add that my favorite stocks, when I ran my prior service, were what I called “no-thesis” stocks: companies that didn’t need a drug approval, regulatory change, innovative product launch, or any particular event to succeed as investments – they could just chug along as they always have.

Sounds boring, but I’m pretty sure Isaac Newton would like no-thesis stocks.

But think about the power of bypassing so many of the booby traps (read: likely-to-be-wrong predictions) that buying no-thesis stocks provides.

It’s not the only way to invest well. But it's a way that's well-suited to most individual investors, and particularly well-suited to 2026, a year of higher-than-average uncertainty. Uncertainty irritates the psyche, and to ease that irritation, people seek predictions – especially confident predictions – almost regardless of their accuracy. (It might be less the prediction itself and more the confidence underlying it that people subconsciously seek.)

So if 2026 gives us an abundance of hard-to-predict events that predictors (likely, at times, yours truly) will be tempted to issue predictions on, no-thesis investing is almost a rebellion in its own small way.

If Isaac Newton can't predict the madness of men, you probably can't, either. Neither can most experts. Translation? Unless you're the exception, the fewer the predictions in your investing, the better.